Alphabet Stock Rebounds After Apple’s AI Search Shock — Analysts Say ‘Buy the Dip’

Published: May 10, 2025

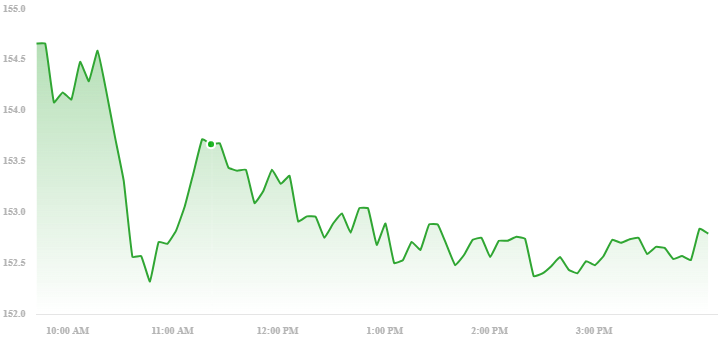

Alphabet Inc. (GOOGL) is recovering after a sharp 7% decline triggered by Apple’s AI search ambitions. Wall Street analysts are now calling the sell-off an overreaction and labeling Alphabet a long-term buying opportunity.

📉 What Triggered the Sell-Off?

The market panic began when Apple’s Eddy Cue testified that AI tools like ChatGPT are reducing traditional search queries on Safari. This hinted at Apple possibly developing its own AI-powered search engine — a direct threat to Google’s dominance.

The result? A $100+ billion drop in Alphabet’s market cap in just one day.

💬 Wall Street Stands Behind Google

- Morgan Stanley: “Overweight” rating reaffirmed.

- Jefferies: Called the sell-off “a gift” for value investors.

- Citi: Maintains $185+ target, bullish on Alphabet’s AI lead.

“This is a momentary dip, not a long-term threat,” said one Jefferies analyst.

🤖 Google’s AI Push: The Real Story

- AI Overviews: Serving 1.5+ billion users monthly

- Gemini LLM: Powering Search, Cloud, Android

- DeepMind: Leading AI breakthroughs in reasoning and robotics

These efforts show Google isn’t just keeping up — it’s redefining how people search.

📈 Is GOOGL Stock a Buy?

Alphabet’s fundamentals remain strong. Analysts argue it’s undervalued compared to Microsoft or Apple, with:

- Low P/E under 17

- Strong cash flow and earnings growth

- Expanding revenue from YouTube, Cloud, and Pixel/Nest hardware

🚀 Trade Alphabet Smarter with AI Bots

Volatile markets create opportunity — if you know how to navigate them. AI trading bots like those from BrokerGenix can help you:

- Spot entry and exit points in real time

- Trade 24/7 without emotional bias

- Mitigate risk with algorithmic discipline

Sign up for BrokerGenix now and start trading smarter — with the help of AI.

I have been looking for a regulatory firm to trade my stocks

What are the necessary information to have access to the trading robot system